Reassessment under section 147/148 subsequent to

revision proceedings initiated twice under section 263

Facts:

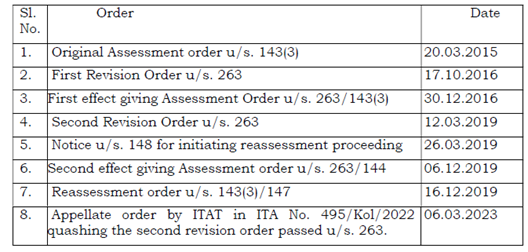

Assessee was in receipt of Share premium from certain

parties. The series of events which happened in the assessment is as

under.

Thus reassessment proceedings were triggered under section

147 and 148 post facto two revision proceedings on the assessee on the same

topic of receipt of share premium. The reassessment was challenged before

the ITAT by the assessee with the plea that the ITAT had quashed the second

revision proceeding as well besides that during pendency of a revision

proceeding and there was no reason to reopen the case under reassessment thus

two parallel proceedings for one assessment year was uncalled for.

Held in favour of the assessee that during pendency of one

revision proceeding there was no requirement to call for reassessment as

well. On merits also the ITAT has quashed the second revision proceedings thus

there was no point to trigger reassessment.

Applied:

S. M. Overseas Pvt. Ltd. v. CIT (2023) 450 ITR 1

(SC) : 2022 TaxPub(DT) 8145 (SC)

Trustees of HEH Nizam Supplemental Family Trust v. CIT

(2000) 242 ITR 381 (SC) : 2000 TaxPub(DT) 1245 (SC).

Case: Pearl Tracom

(P) Ltd. v. DCIT 2023 TaxPub(DT) 7459 (Kol-Trib)